With the aim of building a more environmentally friendly future, Afore XXI Banorte promotes the “Dialogues for Climate in Latin America” initiative, which seeks to decarbonize the economy and combat the challenges of climate change in the region through direct…

Faced with realities such as gentrification, displacement, abandonment and even the pedestrianization of spaces that are normally inhabited and traveled, yardmeeting of fleeting interventions It establishes itself as a “positive actor” through actions that allow us to show “how we…

He Inter Miami managed to maintain its position at the top of the Eastern Conference MLS After a 2-2 draw against Atalanta United, in which Lionel Messi added minutes again, this time as a substitute. The game started with the…

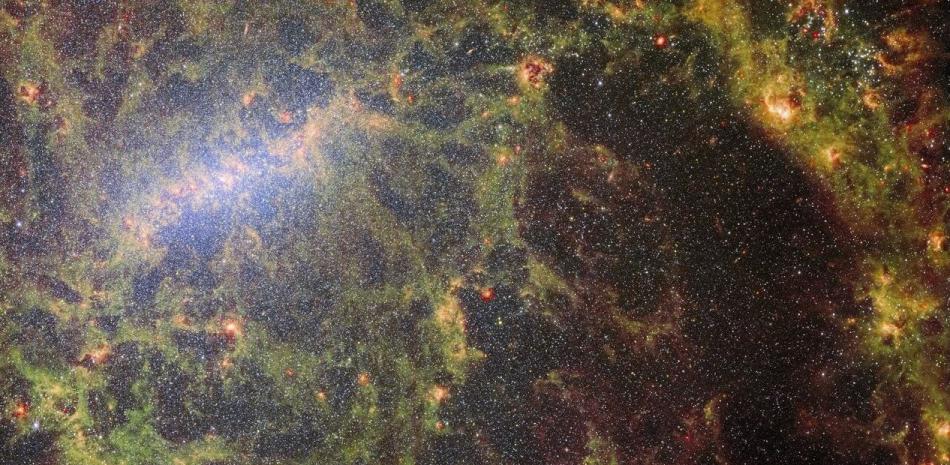

An international collaboration with Spanish participation has published the first catalog of cosmic distances, with data on millions of distant galaxies and their distances, with unprecedented precision, visibility and depth.Carried out by the PAUS project, which involves 14 participating institutions…

Venezuelan protesters cited the UN embassy report Opponent Juan Pablo Guanipa This Tuesday"Terrifying premise"in"Dictatorship of the world” UN on Venezuela As the fact-finding panel documented, the regime intensified its efforts.Crush all peaceful opposition", the country as a "One of the…

«Desde las universidades podemos contribuir al conocimiento y a la toma de decisiones racionales sobre el fenómeno migratorio bajo la perspectiva de la ciencia, la tecnología y la solidaridad». Así lo indicó ayer el rector de la Universidad de Las…

ROME (AP) — Salvatore "Toto" Schillaci, the top-scoring Italian striker at his country's 1990 World Cup, has died and epitomized a player who defied expectations at soccer's biggest event. He is 59 years old. Schillaci was admitted to a Palermo…

Unprofitable September 17 2024, 10:07 PM AP Apple has surprised its users with the new iPhone 16 series of devices, these models introduce interesting innovations such as a new customizable camera button and the first app with the surname "Pro"…

Cuban talent and music will once again attend the awards Latin Grammys 2024 Thanks to many names of musicians and creators from the island appearing on it List of nomineesThis was announced on Tuesday.Award ceremony 25th Anniversary of the AwardsThe…

Career prospects in USA It is witnessing a major shift that could mark the end of an era: the era of remote work. The final decision for Amazon The demand for its employees to return to their offices from January…

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/BH6NLAQGXJGADFWTENBUV7Z7RQ.jpg)