The American technology company, Apple, introduced its new service “Apple Pay Later” (Buy Now, Pay Later) in the United States on Tuesday.

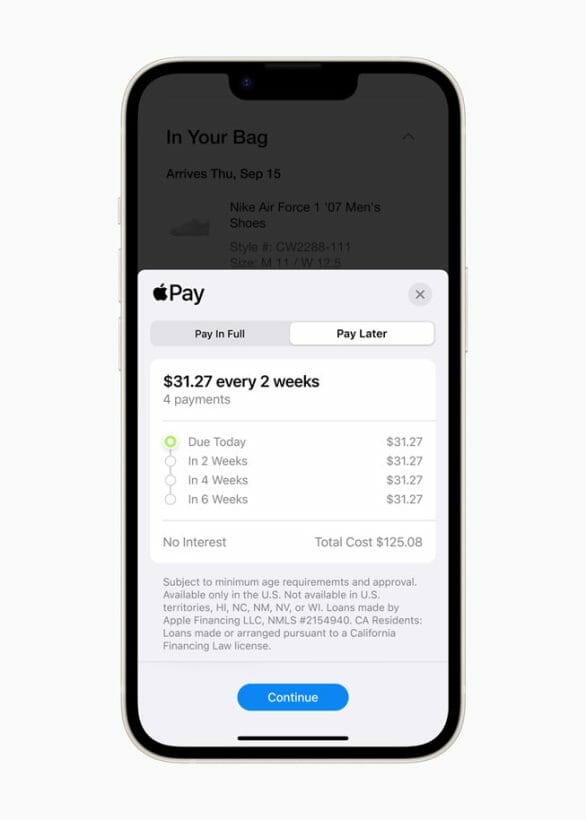

According to a press release posted on its official website, the method was designed “with users’ financial situation in mind,” as Apple Pay Later will allow them to “split purchases into four payments, spread over six weeks, without interest or commissions.”

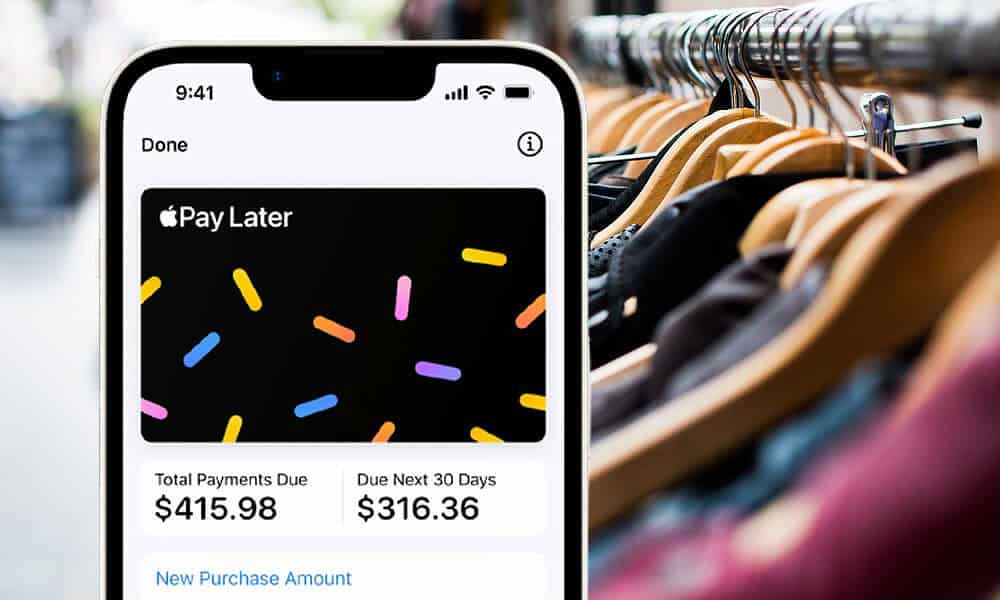

According to the information released, the company’s users will be able to check, manage and pay off their Apple Pay Later loans from the “Wallet” app.

It will be possible to borrow from $50 to $1,000, which can be used for online and in-app purchases made on iPhone and iPad with merchants that accept Apple Pay.

Starting today, Apple will start inviting select users to access a trial version of Apple Pay later. The idea is to offer it to all eligible users in the coming months,” they defined in NB.

“There is no one-size-fits-all approach when it comes to how people manage their finances. Many people are looking for flexible payment options, so we’re excited to offer our users Apple Pay later,” writes Jennifer Bailey, vice president of Apple Pay and Apple Wallet.

Apple Pay Later

The guidance considered that Apple Pay Later facilitates “consumers making informed and responsible lending decisions”.

The service is currently available in the US for online and in-app purchases on iPhone and iPad. Apple Pay Later is available with iOS 16.4 and iPadOS.

As we explained, the method is enabled by the Mastercard installment payment program, so merchants that accept Apple Pay don’t need to do anything to implement it for their customers.

To get started with Apple Pay Later, users can apply for a loan within Wallet, without affecting their balance. They will then be asked to enter the amount they wish to borrow and agree to the terms of Apple Pay later, the statement said.