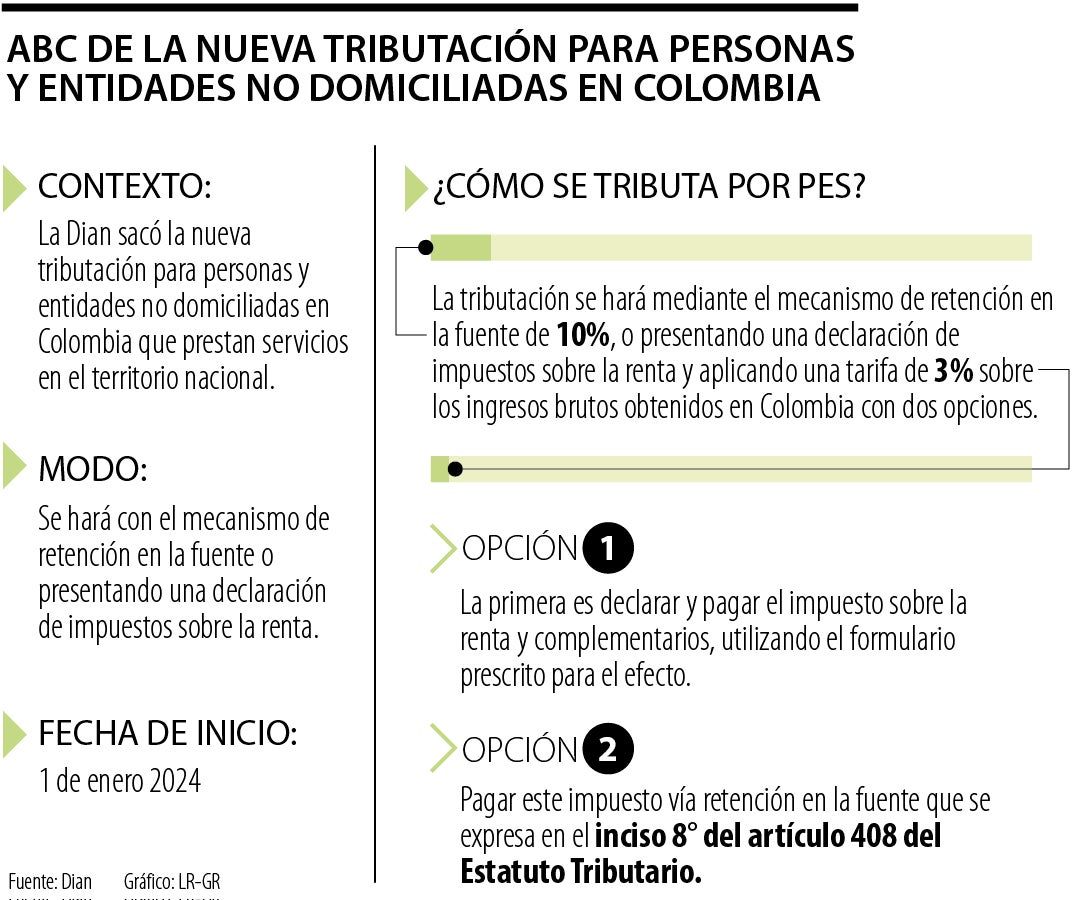

The Dion Introduced new taxation for non-Colombian people and companies providing services in the national territory. This will be done with the mechanism of withholding at source or by submitting an income tax return, the agency said, and from January 1, taxation of significant economic presence, PES, has started to be administered.

According to the Effective Taxation of Significant Economic Presence (PES) Tax Act established by the National Directorate of Taxation and Customs, s.Non-resident individuals and companies not resident in Colombia generate income by selling goods and/or providing services to customers and/or users located in the national territory.

How is PES taxed?

Depending on the company, this taxation is done either through the 10% withholding mechanism at source or through submission of income tax returns. Using the 3% rate on gross income received in Colombia with both options.

First, on occasions indicated by the national government, income and supplementary taxes must be declared and paid using the prescribed form for this purpose. In this case, the taxpayer must choose between not withholding at source (subsection 8 of Article 408 of the Tax Code) or using it. Secondly, this tax must be paid by withholding at source as mentioned in paragraph 8 of Article 408 of the Tax Code.

How to register or renew RUT with PES taxation liability?

PES taxable persons may apply for registration or renewal of RUT, Providing the documents required in Section 11 of Article 1.6.1.2.11. Decree 1625 of 2016 through the following channels such as the 'PQSR and Complaints' service on the Dian website or by scheduling virtual appointments; In this connection.

What documents need to be submitted?

It is divided into two, in the case of natural persons you must have a copy of the identity document. But in the case of companies and institutions, existence and legal representation (in Spanish) must be duly apostilled or legalized copies of the documents. If these documents do not contain information about the country of tax residence, Tax identification number, primary address, postal code, telephone numbers, website and email, these data must be certified by a legal representative or lawyer through a document in Spanish or translated by an official translator and a copy of the legal representative's identification document.

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/BH6NLAQGXJGADFWTENBUV7Z7RQ.jpg)

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/3GK63ATFOMFAYNUAQKUL4WUJFM.jpg)

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/SJ35ZLSJ5NB4BWVRJPSK74P7AQ.jpg)