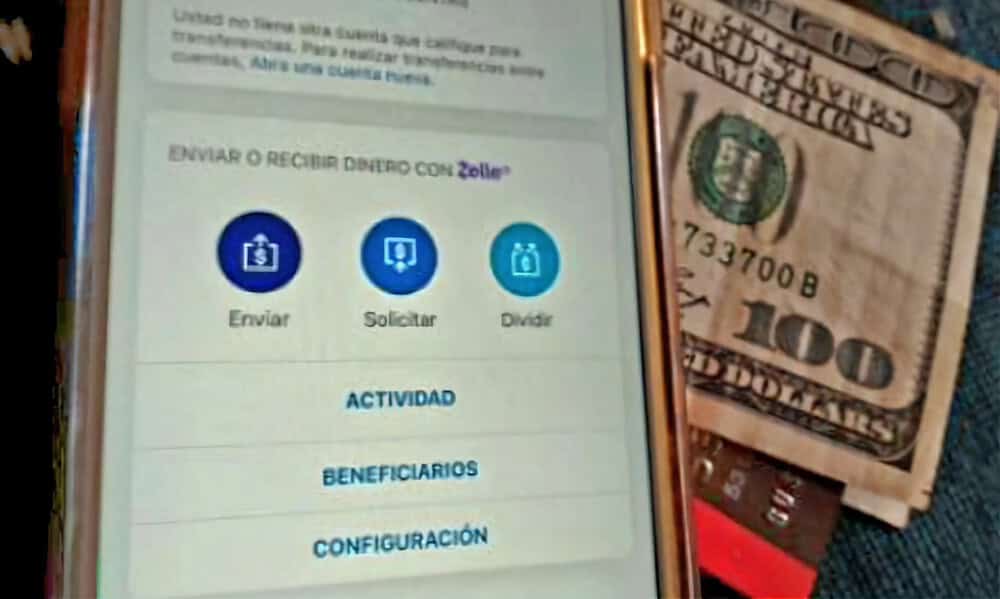

Thousands of victims affected by Zelle scams are already receiving their financial compensation in the United States. This amount exceeds $2.6 billion allocated for this purpose. In the theft, the hackers implicated various banks linked to the aforementioned electronic payment platform. These same entities confirmed that the planned funds had indeed been disbursed to those who suffered from this costly financial fraud. The perpetrators of the robberies deceived their victims by pretending to be a government agency, bank, or existing service provider.

Just on August 30, Zelle acknowledged a new feature so that people who have been defrauded can get their money back. However, not many details have been provided in this regard. It is feared that many other hackers could use this alternative and create a ‘self-payment’.

Ben Chance, Fraud Risk Manager at EWS, commented on the issue. “This situation was well above current legal and regulatory requirements.” For banks, the situation is very complicated in these cases, and even more so if the customer himself is the one making the transfer to a fake recipient. In any case, all bank branches have a policy of returning stolen funds to their owners.

Lawmakers at work

This alternative has attracted the attention of many US lawmakers, especially Elizabeth Warren. She reiterated that “the changes to the Zelle platform are long overdue. “The CFPB stands with consumers and I urge the agency to keep the pressure on Zelle to protect consumers from bad actors.”

By the way, Zelle has grown a lot since it began operations in 2017. It is currently one of the most used platforms for electronic remittances and payments in the United States. However, it has been the subject of countless computer attacks. In 2021 alone, Zelle users lost more than $440 million to scams.